Retail Banking

Driving results in Retail Banking: Smart incentives for high impact teams.

Retail banking spans a diverse ecosystem of institutions—including commercial banks, credit unions, digital-native banks, and community-focused lenders—all united by a common goal: delivering personalized financial services to individual consumers.

Success in this space depends heavily on the people who interact directly with customers. From branch managers driving team performance, to relationship managers deepening client engagement, to loan officers fueling growth through lending, and frontline staff enhancing the customer experience—each plays a critical role.

Incentive compensation is a powerful lever to motivate these teams, boost results, and ensure alignment with both business objectives and customer needs.

1. Individual Incentives

2. Team based Incentives

3. Portfolio-based incentives

4. Hybrid Incentives

Beneficiaries

Incentives for branch managers in retail banking are essential to drive the achievement of commercial objectives, improve customer service quality, and promote effective management of branch resources.

Incentives for customer relationship managers in retail banking are essential to stimulate proactivity in portfolio management, foster customer loyalty, and increase opportunities for the sale of banking products and services.”

Incentives for loan officers in retail banking are crucial to support the acquisition of new clients, improve the quality of the loan portfolio, and drive the achievement of sustainable growth objectives.”

Incentives for frontline staff in retail banking are critical to promote excellent customer reception, support the sale of products and services, and ensure a smooth and efficient customer experience.

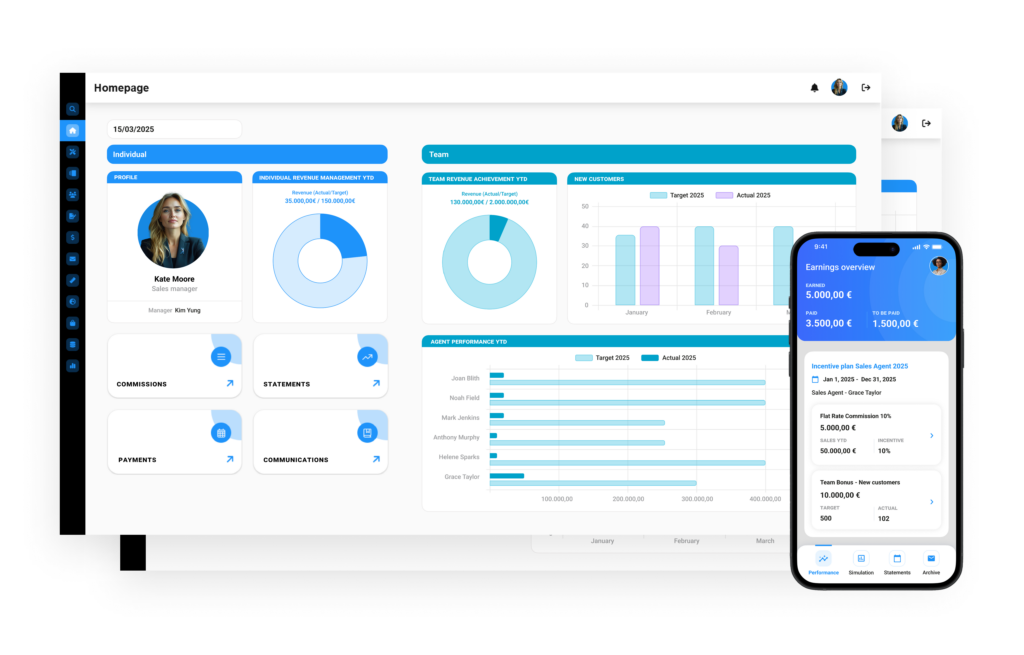

Why You Need Vulki’s modern sales performance management solution

Navigating the complexities of incentive compensation in Retail Banking

Real-Time performance and earnings insights for payees and managers