Insurance

Incentive-Driven Sales Performance in Insurance

Insurance companies operate within two primary categories: Property & Casualty Insurance and Life Insurance. Property & Casualty Insurance covers risks related to property, liability, and accidents, including auto insurance, home insurance, and general liability policies. Life Insurance, on the other hand, pertains to an individual’s life and includes products such as term life, whole life, and annuity policies.

To drive sales performance, insurance companies implement Incentive Compensation Management (ICM) plans, which primarily benefit agencies and sub-agents. These intermediaries play a crucial role in policy sales and customer acquisition, making targeted incentives essential for business growth.

1. Bonuses (Rapel)

2. Short - Term Sales Contests

Beneficiaries

Insurance agencies rely heavily on incentive compensation to drive agent performance, boost sales, and retain clients in a competitive market. Typically structured through commissions, bonuses, tiered rewards, and sometimes non-monetary perks, these incentives align agents’ activities with agency goals such as product mix optimization, customer retention, and compliance.

Sub-agents, who work under primary insurance agents or agencies, also rely on incentive compensation to drive their sales efforts and client management activities. Their incentive structures often mirror those of primary agents, with commissions, bonuses, and performance-based rewards designed to encourage the sale of specific products, achievement of volume targets, and maintenance of high customer satisfaction.

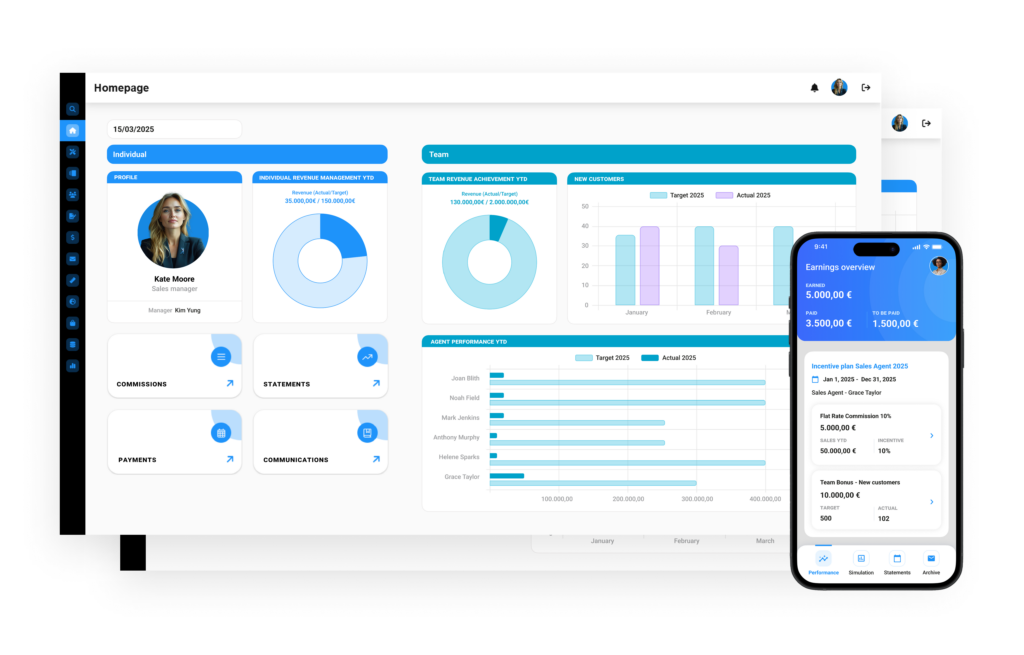

Why You Need Vulki’s modern sales performance management solution

Addressing the Complexities of Incentive Management in Insurance

Real-Time performance and earnings insights for payees and managers